Hi,

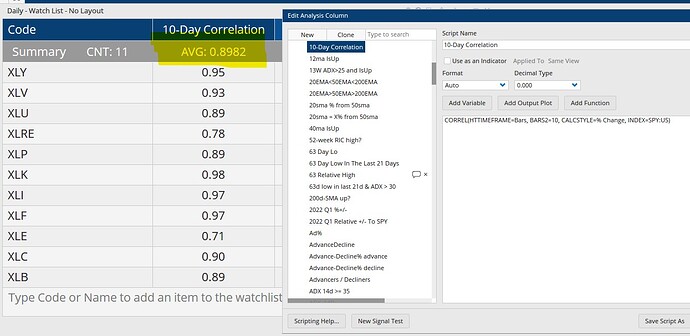

I have a watchlist of the 11 S&P 500 sectors. I have a scripted column calculating the 10-day correlation to SPY.

CORREL(HTTIMEFRAME=Bars, BARS2=10, CALCSTYLE=% Change, INDEX=SPY:US)

Above this column, I have a summary row showing the average. Please see picture 1. That average value, highlighted in yellow, is what I want to plot on a daily basis as a tool under a chart.

I have tried a few things, including the following, which did not work:

//Calculate the sector correlations V1 = ISTICKER(CODE=XLRE:US) ; C1 = CORREL(V1, HTTIMEFRAME=Bars, BARS2=10, CALCSTYLE=% Change, INDEX=SPY:US); V2 = ISTICKER(CODE=XLY:US) ; C2 = CORREL(V2, HTTIMEFRAME=Bars, BARS2=10, CALCSTYLE=% Change, INDEX=SPY:US); //Calculate the average of the sector correlations (C1 + C2) /2

Thank you.