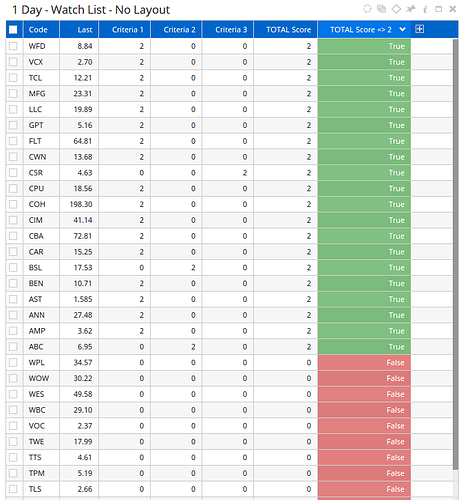

// ----------Creating a Technical Ranking System Scan - not using Watch Lists------------

// Inspired by Darren Hawkins Blogs

// Scanning for a number of patterns and assigning points for each pattern

// This is a stripped down version of patterns and points - will add more can thin out the scan list based on the Technical Rank Value

//------------Scanning for a MA12 touch------------

// Set RG1 to 30% of the last day range

RG1 = ATR(Day(PERIODAMOUNT=1), BARS=1) * 30/100;

// Set MA1 and MA2 ranges to plus/minus RG1

MA1 = MA(BARS=12, STYLE=Exponential, CALC=HL Average) + RG1 ;

MA2 = MA(BARS=12, STYLE=Exponential, CALC=HL Average) - RG1;

// Check if the High or Low falls within these ranges

H1 = (HIGH() <= MA1 and HIGH() >= MA2);

L1 = (LOW() <= MA1 and LOW() >= MA2);

// Check if any of these conditions are true

Z1 = H1 or L1;

// Set this Technical Indicator to 2 points

V1 = 2;

//------------Scan for a Gartley------------

G1 = GPS(SCANTYPE=Both) Matches;

Z2 = G1;

// Set this Technical Indicator to 2 points

V2 = 2;

//------------Scanning for Oliver's Wedge------------

W1 = SWINGSTART( OLIVERWEDGESCAN(INSIDESWING=Three) ) Matches;

Z3 = W1;

// Set this Technical Indicator to 2 points

V3 = 2;

//------------Scanning for 3 Higher Lows------------

// Check for 3 Higher Lows and the third one is noy yet confirmed -set of stairs possibility

GS1 = GANNSWING(METHOD=USE NEXT BAR);

3HL = SWINGDOWN(GS1) AND ((SWINGEND(GS1) > SWINGEND(GS1,OFFSET=2))

AND

((SWINGEND(GS1,OFFSET=2) > SWINGEND(GS1,OFFSET=4))

AND

(SWINGEND(GS1,OFFSET=1) > SWINGEND(GS1,OFFSET=3))))

AND

LOW() > (SWINGEND(GS1,OFFSET=2));

//Check both conditions are true

Z4 = 3HL;

// Set this Technical Indicator to 2 points

V4 = 2;

//------------Scan for 3 Lower Tops------------

// Check for 3 Lower Tops and the third one is not yet confirmed - set of stairs possibility

GS2 = GANNSWING(METHOD=USE NEXT BAR);

3LT = SWINGUP(GS2) AND ((SWINGEND(GS2) < SWINGEND(GS2,OFFSET=2))

AND

((SWINGEND(GS2,OFFSET=2) < SWINGEND(GS2,OFFSET=4))

AND

(SWINGEND(GS2,OFFSET=1) < SWINGEND(GS2,OFFSET=3))))

AND

SWINGEND(GS2,OFFSET=2) > HIGH();

//Check that both conditions are true

Z5 = 3LT;

// Set this Technical Indicator to 2 points

V5 = 2;

// Check that the stock has and ADX greater or equal to 20

DX = ADX(#ADX Bars:BARS=12) >= #Value:20;

//------------Only choose stocks that fit the scan criteria------------

(Z1 or Z2 or Z3 or Z4 or Z5) and DX;

//----------Add up the Technical Indicators

TECH = V1+V2+V3+V4+V5;

//------------Only select Stocks with a score of 4 or higher (This does not work)

TECH >= #Value:4;