Hi, I’ve been working with timeframe overrides a bit recently.

I’ve found something that’s a little confusing, but I might be misunderstanding something so I’m hoping someone might have some advice or insight.

I’ve got a daily line chart of SPX showing the daily close price. Overlaid on that I have a plot of the weekly close using the formula:

CLOSE(Week(PERIODAMOUNT=1))

I've then put the same formula as a custom label on the cursor.What I’ve found is that the plot of the weekly close formula is different from the cursor value of the same weekly close formula.

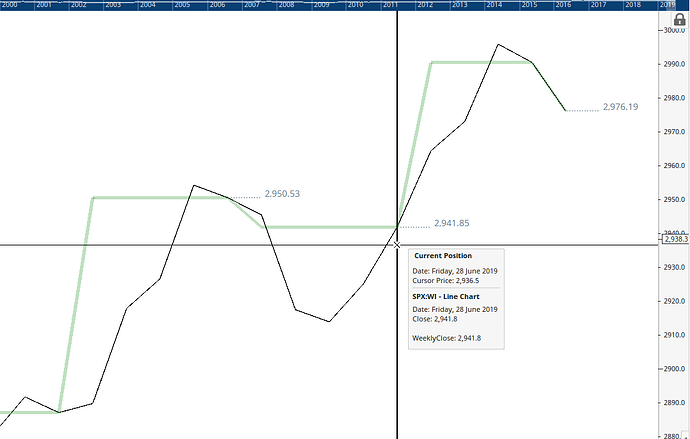

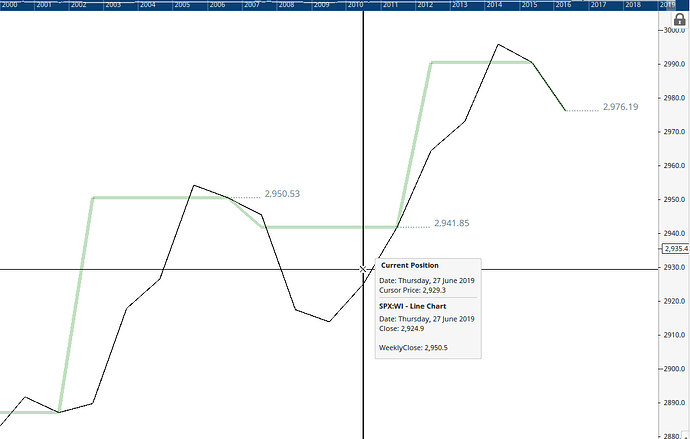

This is illustrated with two screen shots.

The first screen shot (Friday.png) shows the cursor over a Friday, where the cursor value of the weekly close, the plot of the weekly close (thick green line) and the Friday daily close (thin black line) all intersect, and agree with each other, at about 2941.8. As expected. All good.

The second screen shot (Thursday.png) is on the day before (Thursday). The daily close has changed to 2924.9. The plot of the weekly close (thick green line) remains at 2941.8. But the cursor value of the weekly close has changed to 2950.5. The cursor value and the plot are different, even though they both use the same formula.

It seems that the cursor value of the weekly close has changed to the previous week’s closing value of 2950.5. That sort of makes sense, but then why is the plot giving a different outcome? Or is it that the plot giving the correct outcome and that the cursor value is in error?

Has anyone experienced something similar or have any advice or insight on this issue?

Many thanks, Dean