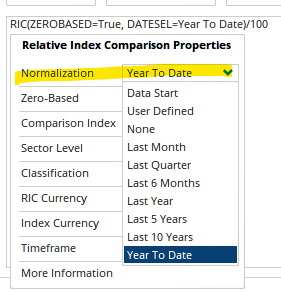

Hi, If I want to know how much a stock is outperforming the SPX index by percentage points, is this a correct script to achieve that [RIC(DATESEL=Year to date, ZEROBASED=True, INDEX=SPX)/100]? Is it dividing the year to date return of the stock by the year to date return of the index?

Also, is there a way to use this function to calculate a certain period range in history instead of going from the start date all the way to the present date?

Thanks in advance