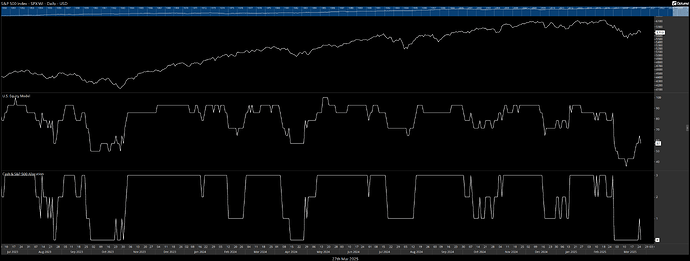

I have been working on a binary backtest using a simple 0, 1, 2, 3 logic, where 0 = Cash and as the numbers increase the S&P 500 leverage corresponds accordingly, but I am getting overlapping trades with the signals and am wondering if I have structured my Entry or Exit logic incorrectly.

My general binary criteria is scripted in the bottom clip below:

Entry signals are when the model changes into a new position and then becomes 100% of the new allocation.

Model = SCRIPT(SCRIPTNAME=Cash and S&P 500 Allocation) ;

Model ChangeTo 0 and ISTICKER(CODE=SHV:US) or

Model ChangeTo 1 and ISTICKER(CODE=SPY:US) or

Model ChangeTo 2 and ISTICKER(CODE=SSO:US) or

Model ChangeTo 3 and ISTICKER(CODE=UPRO:US)

Exit signals are generated when the model changes from anything other than the current signal. IE, if the model is currently +1 (SPY), and moves to 0 or +2 or +3, either SHV, SSO, or UPRO becomes the new allocation.

Model = SCRIPT(SCRIPTNAME=Cash and S&P 500 Allocation) ;

( Model ChangeTo 1 and ISTICKER(CODE=SHV:US) ) or

( Model ChangeTo 0 or Model ChangeTo 2 or Model ChangeTo 3 ) and ISTICKER(CODE=SPY:US) or

( Model ChangeTo 0 or Model ChangeTo 1 or Model ChangeTo 3 ) and ISTICKER(CODE=SSO:US) or

( Model ChangeTo 2 or Model ChangeTo 1 or Model ChangeTo 0 ) and ISTICKER(CODE=UPRO:US)

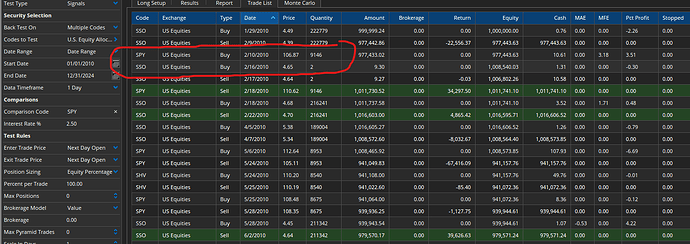

However when looking at the trade list, multiple ETFs are being purchased during periods when only one asset should be chosen.

For instance on 2/10 and 2/16 there are two entries for SPY and SSO without a corresponding sell of SPY and then a subsequent buy into SSO.

I am assuming that I have scripted the Entries and Exits wrong, but not sure of a better way to approach.

I sincerely appreciate the assistance as always.

EK