Hi,

I want create a script for the compound annual growth rate (CAGR).

The Excel formula is: =(end value/start value)^(1/periods)-1

or e.g.: =(((A11/A1)^(1/10))-1)

I want then chart the S&P 500 as a bar chart and in a window below the chart the CAGR values as a histogram with positive/negative settings.

Can give me some hints, how I can do this?

Thanks,

Thomas

Hi Thomas,

You can use the Power() function to achieve the result you are after. The following example can be used on a Daily chart to show the CGAR values (i’m using a 10 year comparison as per your Excel example, but you can adjust this script to use any other time frame):

//Get current and 10 year offset closing prices

V1 = CLOSE(Year(PERIODAMOUNT=1)) ;

V2 = CLOSE(Year(PERIODAMOUNT=1), 10) ;

//CGAR Calc

V3 = (V1 / V2);

$V4 = (1/10);

V5 = (POWER(V3,POWER=$V4) - 1)*100;

V5

Here is an example of how the script works on a Show View:

Would the Annual Rate of Return function work as well?

Hi Michael,

as far as I know calculates the ARR only the return of one year, whereas the CAGR measures the average return per year over a given period of years.

You can search in the Internet for ARR or CAGR, there are a lot of examples for both.

Annual Rate of Return may do what you need to, i had a quick look and the values appear to line up with my manual script year to year:

https://help.optuma.com/kb/faq.php?id=1112

To calculate the CAGR since inception:

//Calculate number of trading years;

Y1=LAST(YEARNUM()) - FIRST(YEARNUM());

//Get current close and first open prices;

V1 = CLOSE() ;

V2 = FIRST(OPEN());

//CGAR Calc using the number of trading years;

V3 = (V1 / V2);

$V4 = (1/Y1);

CAGR = (POWER(V3,POWER=$V4) - 1);

CAGR

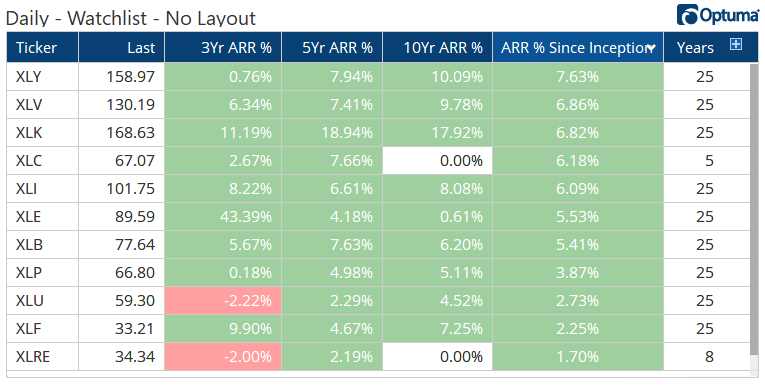

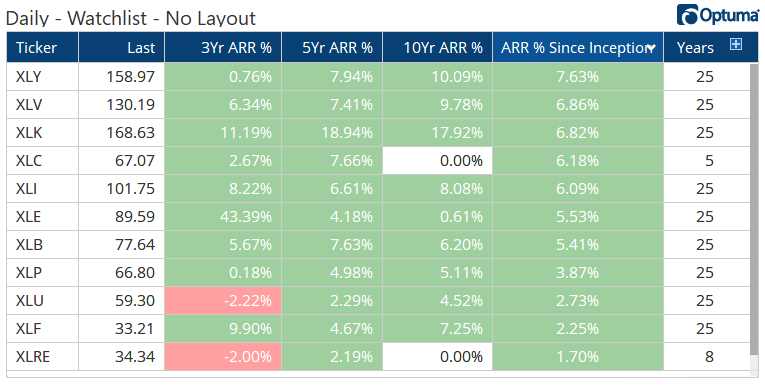

In this example for the SPDR Sector ETFs, Consumer Discretionary $XLY has gained an average of 7.63% over the last 25 years, compared to only 1.7% for Real Estate $XLRE over the 8 years it has been trading. However, when looking at the 3 year ARR % column, Energy $XLE leads with 43.4% per year, with -2.2% for Utilities $XLU.