Sorry for the duplicate, thought I had found an issue but turned out it was unrelated.

I may just be miss understanding how the multi code test works, but it is giving me trades that don’t accurately match my rules.

I understand that it won’t enter a trade if cash isn’t available, but it just seems plain wrong.

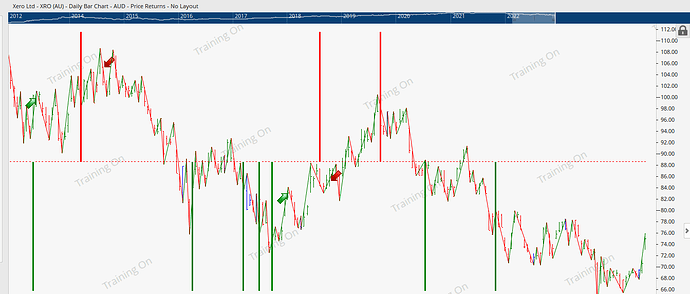

Single Code

On a single code chart it enters correctly:

(Rule is clear the peak after consecutively higher troughs (Gann swing entry) AND a green histogram within a 10 bar lookback)

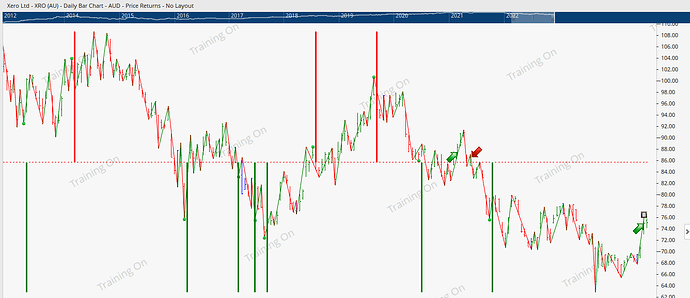

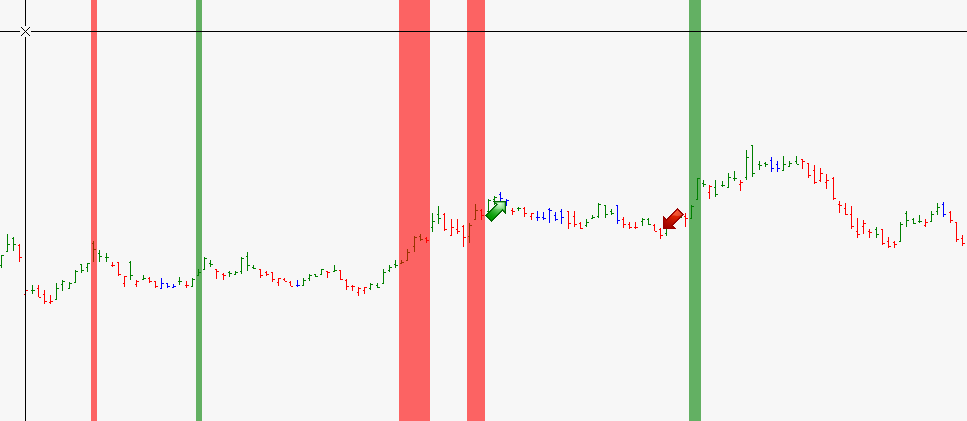

Multi Code

This is the same period and stock when run as part of a multi code backtest of the asx100.

It pretty much completely ignores the lookback for the histogram, but if I remove that from the rules the trades changes so it is still taking it into account somehow. The histogram is a pascal tool if that makes any difference, but should just spit out +1, -1 or 0.

Once again, any ideas or help would be greatly appreciated.

Entry rule script:

Rev = REVERSALPATTERNSBACKTESTING(); //The Pascal histogram tool

RevBack = BarsTrue(Rev == -1, Lookback = 10) > 0; //Check if it's been -1 in the last 10 bars

Res = (RevBack and SCRIPT(ScriptName = GannSwingEntry)); //Check for higher trough and cleared peak AND reversal pattern in last 10 bars.

Res;