Hi,

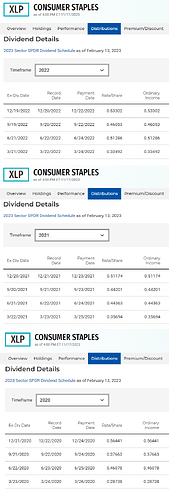

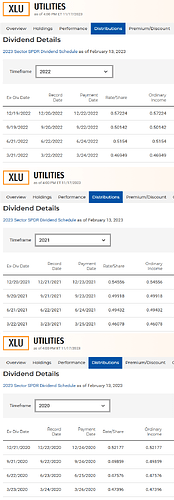

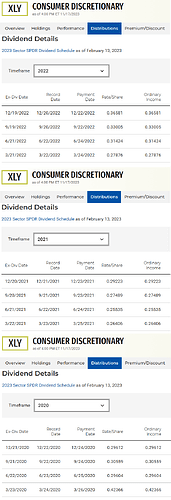

I created a total return index of the three defensive SPDR sector ETFs (Health Care, XLV; Consumer Staples, XLP; and Utilities, XLU) with the Custom Code Builder.

Here is the script:

// Getting the Defensive Sector Total Return Data of ETFs Line1 = GETDATA(CODE=XLV:US, PRICEADJUSTMENT=Total Returns) ; Line2 = GETDATA(CODE=XLP:US, PRICEADJUSTMENT=Total Returns) ; Line3 = GETDATA(CODE=XLU:US, PRICEADJUSTMENT=Total Returns) ; // Calculating the Equal-Weighted Total Return Index of Defensive Sector ETFs Line4 = POWER(POWER=0.3333, Line1 * Line2 * Line3) ; Line4

The script works as it should, no problem.

I have also created a total return index of the three defensive sector indices (Health Care, SP500-35TR; Consumer Staples, SP500-30TR; and Utilities, SP500-55TR) with the Custom Code Builder.

The script is the following:

// Calculating the Equal-Weighted Total Return Index of Defensive Sector Indices POWER(POWER=0.3333, SP500-35TR:SPI * SP500-30TR:SPI * SP500-55TR:SPI)

Again, the script works as it should, no problem.

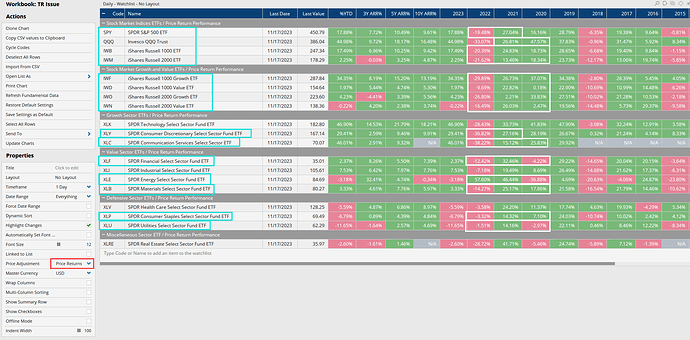

Now I have created a Relative Comparison Chart with the base 10-year ago.

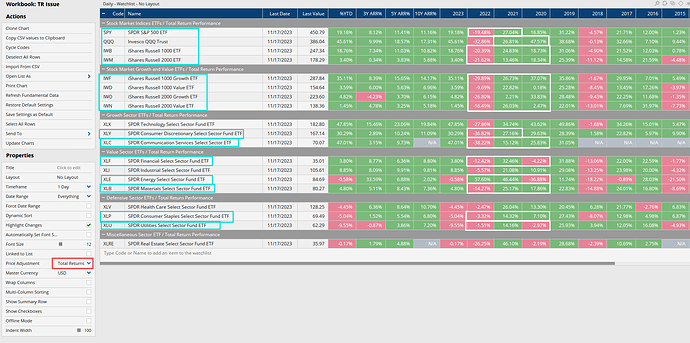

Here is the chart:

As you can see, the spread between these two total return indices is very wide at around 17.4%.

I have no idea why the spread has started to widen since 2020.

Does anyone have a suggestion as to why the spread between the two total return indices is so wide?

Thanks very much for any suggestion.

Best wishes,

Thomas