Hi Sir

There is a small mismatch from dates i am seeing from somewhere else for fed rate cut.

Hi Darren,

Twitter now X sends its greetings once again.

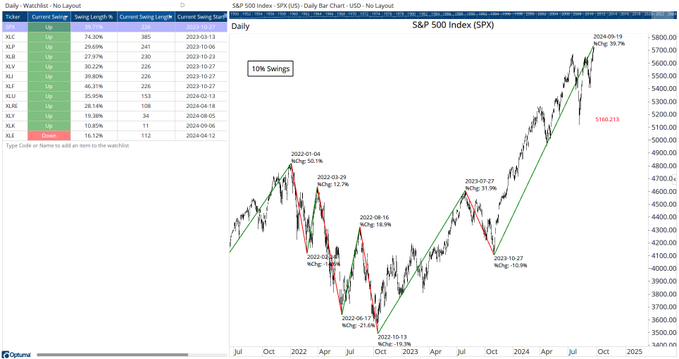

You have published an interesting swing watchlist on X. Here is the link and the chart:

My request is once again whether you can publish the watchlist here in the forum or the scripts for the columns in the watchlist.

Thank you again for your great suggestions and support.

Thomas

Hi Thomas,

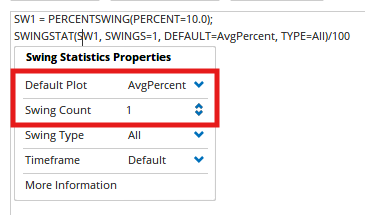

The Swing Length % column uses the SWINGSTAT function set to AvgPercent for 1 swing (ie the current swing):

SW1 = PERCENTSWING(PERCENT=10.0);

SWINGSTAT(SW1, SWINGS=1, DEFAULT=AvgPercent, TYPE=All)/100

Workbook attached for the all the columns.

10PctSwings.owb (33.3 KB)

Hi Darren,

Nice to have you back.

We have missed you in the last few weeks. I hope you are well and hopefully you had a relaxing and certainly well-deserved vacation.

Thank you very much for the swing workbook.

Thomas